This product launch fully demonstrates the latest innovation achievements of Hi Sun Technology in the field of Fintech, and Outlines the future of bank it system construction that is more efficient, intelligent and innovative.

During the event, Frank Fong, Vice President of Hi Sun, introduced the product features of IBS V9.0:

– Product Highlights: A scenario-centered innovative banking core system suite, providing solid technical support for business innovation.

– Product Name: IBS (Innovative Banking Suite) V9.0

– Product Features:

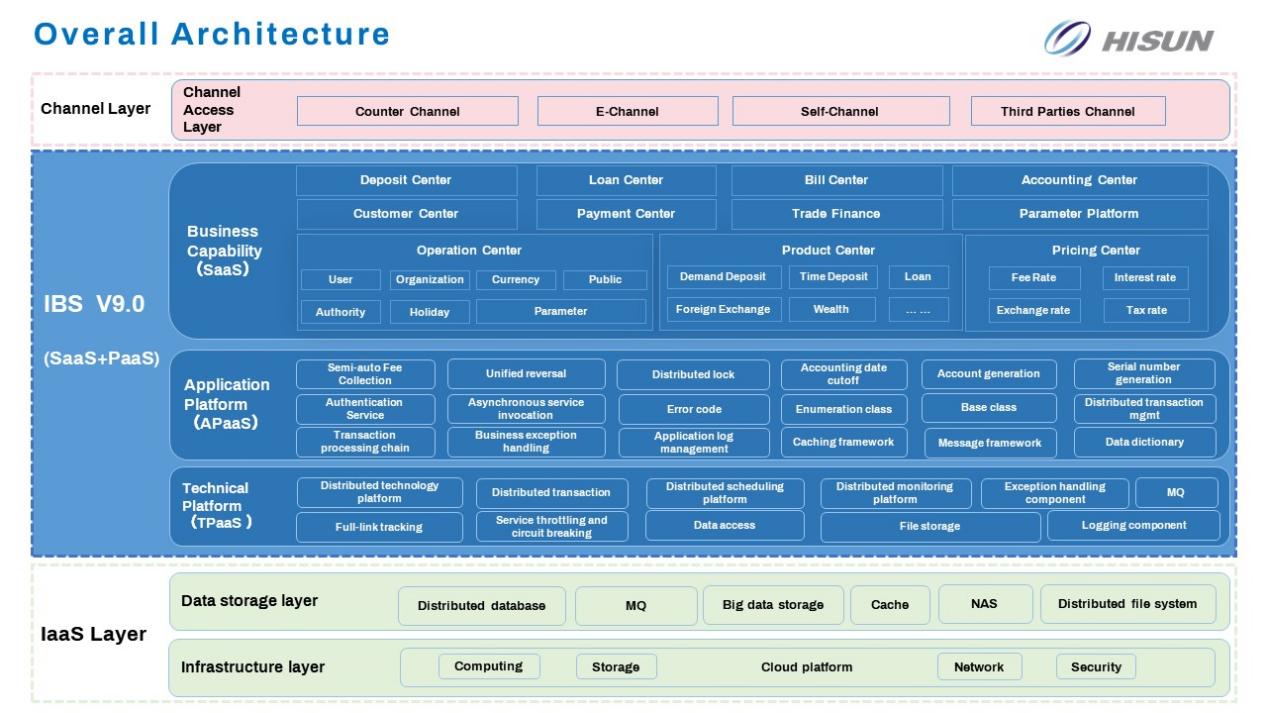

- Domain-based business architecture, adopting the micro-services domain modeling concept to ensure the advancement of the business architecture;

- Model-based application architecture, adopting the best-practice model-based design concept to support future development with a flexible architecture and process;

- Integrated technical architecture, adopting an advanced distributed architecture to ensure the efficiency, stability, and scalability of the system;

- Standardized data architecture, unifying data standards to ensure the effective development and inheritance of the bank’s data assets;

- Unitized deployment architecture, supporting unitized deployment, and enabling flexible deployment based on the actual business service scope and data volume;

- Automated operation and maintenance architecture, thoroughly sorting out key indicators in the design of the application system, and combining with automated monitoring tools to achieve automated system operation and maintenance management.

-Technological Innovation: Introducing micro-services architecture and cloud-native design to enhance the flexibility and maintainability of the system.

-Application Scenarios: Suitable for various banking business scenarios, meeting the changing business needs and supporting business innovation.

-Problem-solving: Solve the problems faced by traditional banking systems, such as data processing bottlenecks and slow business responses, and significantly improve the efficiency of bank business processing and customer experience.

IBS V9.0, Hi Sun’s latest core banking product, has accumulated the previous four generations of products and hundreds of bank core implementation and delivery experience. It adopts the best practices of DDD domain driven design and domain modeling methods, decoupling the bank’s core business modules, and a new generation of distributed core business system based on cloud native architecture and micro-service design.

Based on years of experience in the construction of bank core systems, in accordance with the requirements of banks for the security, stability and reliability of information systems, Hi Sun has carried out strict functional testing, performance testing and stability testing after completing the adaptation with various products, and the test results have been unanimously recognized by all manufacturers and meet the security requirements of financial regulators.

Currently, the IBS V9.0 system has reached strategic partnerships with many ecological partners. At the infrastructure layer, it has completed technology adaptation and related certification work with domestic mainstream manufacturers, including Alibaba, Huawei, Tencent, ZTE, and others, which has shown superior technical performance pointer data, and also reflects the good compatibility of various partners in the system architecture.

In addition to core banking products, Hi Sun’s innovative products in other Fintech fields were also introduced at the event, including nine cloud migration technologies for core banking system, Smart Payment Platform, AI Application Scenarios in Fintech, and Web 3.0 solutions.

– Nine cloud migration technologies for core banking system: Core bank system supporting tools to help the core banking system to achieve a non-inductive cloud, to ensure the inheritance of banking assets.

– Smart Payment Platform: An enterprise-level payment platform providing the capability to uniformly interface with various external payment channels, such as SWIFT/CHATS/FPS, supporting various message formats including MT messages and automatic conversion of ISO20022 XML messages. Supporting multiple currencies such as RMB, USD, HKD, providing cross-border payment capabilities.

– AI Applications: Mainly integrating major model factories to assist banks in quickly building application scenarios such as regulatory policies and intelligent business training etc.

– Web 3.0: Joining the Hong Kong Web3.0 Institute as the leader of the security compliance group, jointly publishing the “Security Compliance White Paper on Web 3.0,” and launching solutions such as VASM, digital wallets, and smart contracts.