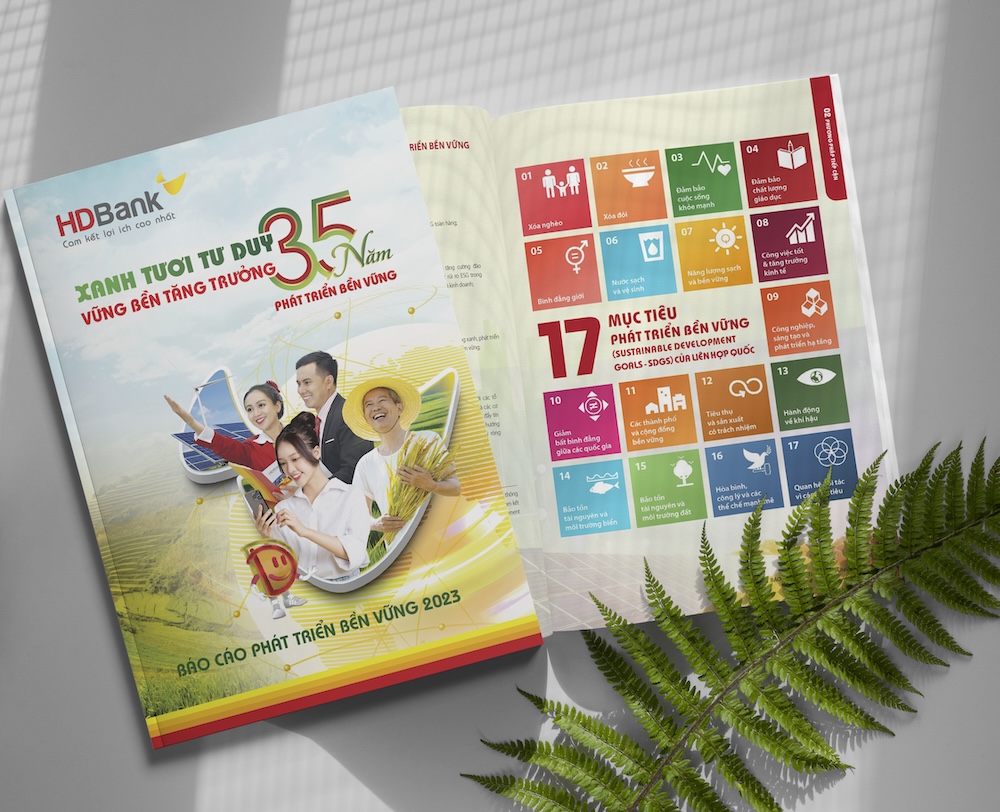

The Sustainability Report, titled “Green Thinking, Sustainable Growth” was prepared following Global Reporting Initiative standards, provides comprehensive insights into the bank’s environmental, social, and governance (ESG) strategies.

It outlines its objectives, strategic vision, implementation plans, and achievements, showcasing the bank’s dedication to sustainable practices.

Mr. Kim Byoungho, chairman of HDBank’s board of directors and its ESG committee, said: “At HDBank, we understand that our actions today shape a better tomorrow. We embrace our responsibility to create value for society, safeguard the environment, foster a green economy, uphold human rights, and build a sustainable future.”

Aligned with the Global Sustainability Standards Board and United Nations Sustainable Development Goals, the report emphasizes HDBank’s commitment to global sustainability benchmarks.

The bank aims to be a Net Zero Bank, promoting green finance, green transformation, and sustainable finance while prioritizing the welfare of the community, society, and employees.

HDBank’s commitment to financial inclusion is evident in its policies and programs that offer a wide range of customers access to its financial services, including small and medium-sized enterprises, workers, farmers, small businesses, and low-income individuals.

The bank’s modern digital banking platform ensures effective reach and service to these customers. According to the report, 94% of retail transactions were executed using digital platforms and the number of new to bank customers in 2023 exceeded those from traditional channels.

HDBank’s dedication to social responsibility is further exemplified by its employee-driven social security and welfare programs, which have earned the bank recognition as a “Best Place to Work in Asia” for six consecutive years.

The bank’s efforts to integrate ESG considerations into its risk management framework demonstrate its commitment to sustainable growth and responsible banking practices.