Achieved 10 EH/s milestone ahead of schedule

SYDNEY, Australia, May 15, 2024 – IREN (Iris Energy Limited) (NASDAQ: IREN) (together with its subsidiaries, “IREN” or “the Company”), a leading next-generation data center business powering the future of Bitcoin, AI and beyond, today provided a business update.

Key Highlights

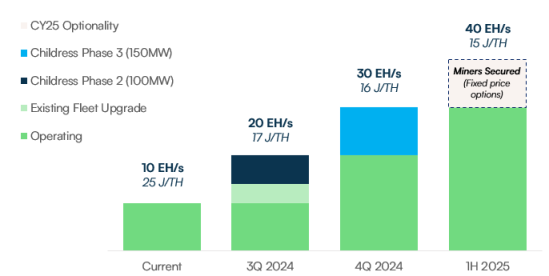

- Operating hashrate currently 10 EH/s, milestone achieved ahead of schedule

- 2024 expansion plans increased to 30 EH/s

- Secured latest-generation Bitmain S21 Pro miners with nameplate efficiency of 15 J/TH

- Upon completion, nameplate fleet efficiency of 16 J/TH and indicative electricity cost per Bitcoin mined of $17k

- Additional 50MW data center expansion at Childress (announced April 29, 2024)

- Funding through existing cash and other sources

- Additional Bitmain S21 Pro miner purchase options (10 EH/s) supporting expansion pathway to 40 EH/s in 1H 2025

2024 expansion plans increased to 30 EH/s

The Company’s previously announced 2024 expansion plan to 20 EH/s has been increased to 30 EH/s.

This accelerated growth is enabled through amended and new agreements with Bitmain, along with the construction of an additional 50MW of data center capacity at Childress in 2024.

- Existing agreements – Bitmain T21/S21 purchase (5 EH/s)

- Amended agreement – Bitmain T21 options (11 EH/s)

- Flexibility, when exercising the options, to select either Bitmain T21 or S21 Pro miners (or a combination of):

- $14.0/TH for Bitmain T21 (unchanged); or

- $18.9/TH for Bitmain S21 Pro (new)

- Contract size of up to 9 EH/s (if T21 selected in full) or 11 EH/s (if S21 Pro selected in full)

- Option expiry in March 2025 (previously September 2024)

- Flexibility, when exercising the options, to select either Bitmain T21 or S21 Pro miners (or a combination of):

- New agreement – Bitmain S21 Pro purchase and options (24 EH/s)

- 12 EH/s purchase at $15.1/TH (plus $3.8/TH payable 9 months after delivery); and

- 12 EH/s options at $18.9/TH

- 10 EH/s of which supports expansion pathway to 40 EH/s in 1H 2025

- Childress expansion plan in 2024 increased by 50MW

- Enabled partly through a new substation design, as well as ongoing improvement and optimization of the Company’s construction and procurement process

- Global data center capacity now planned at 510MW by the end of 2024

- Upgrade of the existing miner fleet across British Columbia and Texas

Pathway to industry leadership

The latest-generation S21 Pro miner was recently launched by Bitmain in March 2024 with an industry-leading 15 J/TH efficiency.

IREN is poised to become the most efficient and one of the largest publicly-listed Bitcoin miners, with an overall nameplate fleet efficiency of 16 J/TH and indicative electricity cost of $17k per Bitcoin mined at 30 EH/s.

The Company plans to fund the expansion to 30 EH/s through existing cash and other sources. As of April 30, 2024, the Company had $321.5 million cash and no debt facilities.

The Company continues to consider a range of funding opportunities such as equity, corporate debt and equipment financing.

30 EH/s expansion timeline

The Company’s previously announced expansion plans are progressing ahead of schedule.

IREN now expects to achieve 20 EH/s in 3Q 2024 and 30 EH/s in 4Q 2024, with growth optionality to 40 EH/s in 1H 2025.

Planned expansion timeline:

Assumptions and Notes

- Cost per bitcoin mined represents indicative electricity cost per bitcoin mined assuming 30 EH/s, nameplate fleet efficiency of 16 J/TH, weighted average power cost of $0.037/kWh ($0.045/kWh in BC and $0.033/kWh in Texas – latter calculated using actual monthly average net power price at Childress during FY24 to date (i.e. July 2023 to March 2024), including ERS revenue and adjusted for now eligible 4CP benefit), current global hashrate of 595 EH/s, block reward of 3.125 BTC per block and transaction fees of 0.3 BTC per block.

- The new option agreement for 12 EH/s of Bitmain S21 Pro miners can be exercised incrementally until May 2025. The amended option agreement for 9 EH/s of T21 miners or 11 EH/s of S21 Pro miners can be exercised incrementally over the option period until March 2025. An initial downpayment option fee equal to 10% of the total purchase price is associated with both option agreements.

- Cash of $321.5 million reflects USD equivalent, unaudited preliminary cash, cash equivalents and term deposits as of April 30, 2024.