DUBAI, United Arab Emirates, June 03, 2024 – OKX, a leading crypto exchange and Web3 technology company, today announced the launch of its ‘Hybrid Spreads’ orderbooks, which enable professional traders and asset managers to execute spread trades between legs of different margin currencies from a single orderbook with zero leg risk and margin efficiencies gained from a delta-hedged atomic execution.

This addition to OKX’s Nitro Spreads, a venue within OKX’s Liquid Marketplace for executing basis, futures spreads and funding rate arbitrage strategies, is the first of its kind in the industry and opens up new trading opportunities for institutional traders.

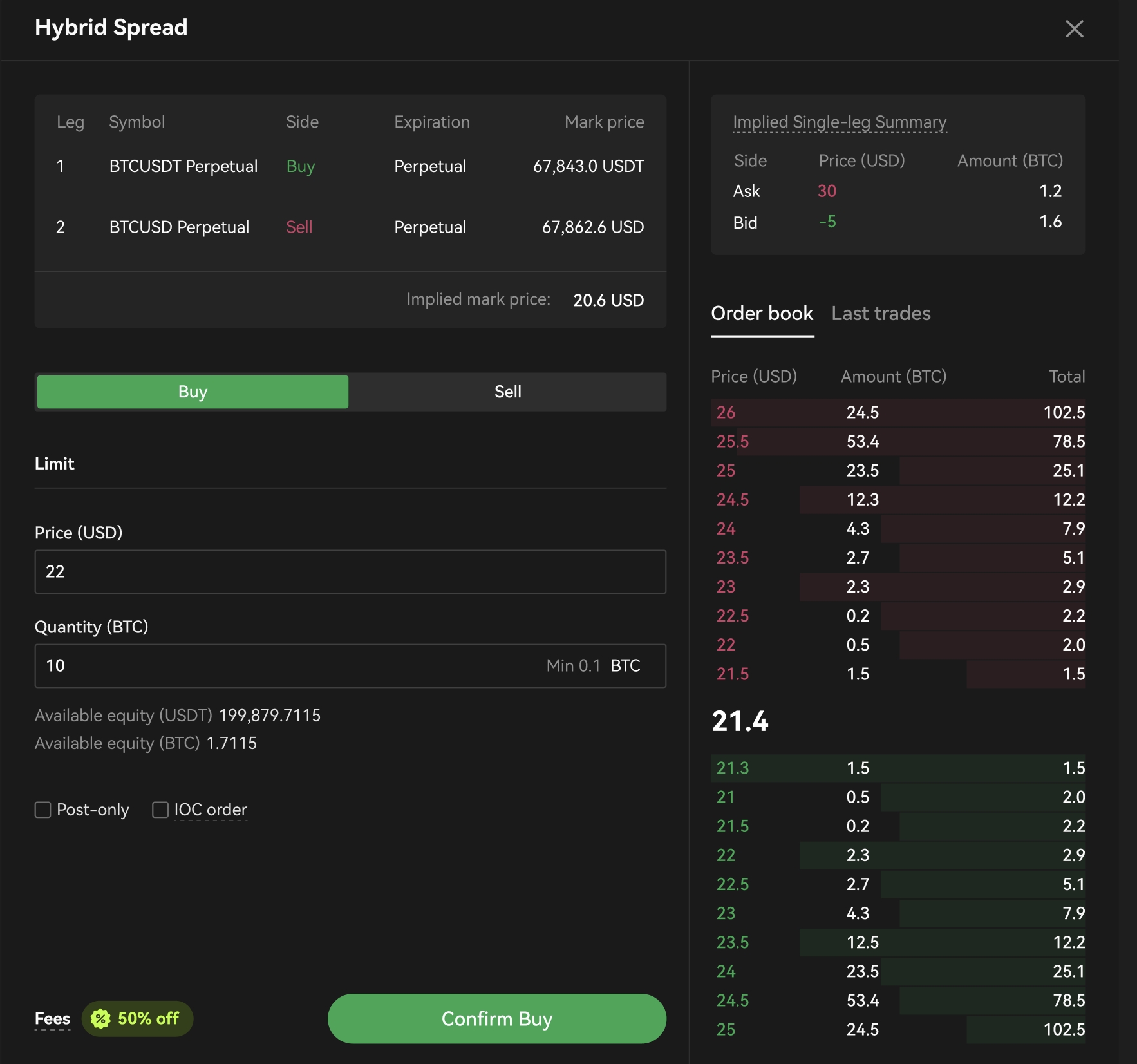

Exclusively available on OKX’s Nitro Spreads platform, Hybrid Spreads enables customers to execute trades between legs with varying collateral currencies in a single execution, rather than multiple ones. For example, with Hybrid Spreads, users can hold an offsetting long BTC spot position and short BTC crypto-margined perpetual futures to accumulate funding payments in Bitcoin.

The innovative Hybrid Spreads unlocks advanced yield harvesting and arbitrage strategies, such as cross-margin funding rate arbitrage and basis trading, between major crypto perpetual futures. Additionally, implementing this functionality through Nitro Spreads enhances the marketplace experience – for both market makers and asset managers – by:

- Eliminating leg risk through atomic execution

- Reducing slippage with spread price limit orders

- Offering greater liquidity due to portfolio margin efficiencies realized via spread orders versus individual orders

These benefits come without sacrificing execution certainty, pricing or composability of a portfolio, making Nitro Spreads a leading choice for advanced trading strategies.

OKX Global Chief Commercial Officer Lennix Lai said: “Since introducing Nitro Spreads, we have captured 60%* of the cryptocurrency spread trading market share. We have now upgraded Nitro Spreads with Hybrid Spreads orderbooks, allowing traders to execute advanced yield harvesting and arbitrage strategies while reducing capital costs and slippage when executing legs with different collateral currencies. This feature is especially popular among market-neutral traders.”

OKX offers a range of trading solutions, such as the Liquid Marketplace platform, which includes Nitro Spreads, providing unmatched liquidity and adaptability for institutions. Moreover, the exchange is continuously broadening its suite of institutional offerings and features. For example, OKX recently introduced a new ‘Quick Trading’ mode on Nitro Spreads, enabling users to instantly select the ‘Top of Book’ on any spread/side through a double-click, thereby eliminating the need to manually open order books or enter details.

This announcement follows the launch of OKX’s inaugural ‘Institutional Basis Trading Report.’ The report analyzes the institutional basis trading landscape and strategies, as well as drivers behind the nearly 30% Ethereum (ETH) and Bitcoin (BTC) annualized basis observed towards the end of March 2024.

For more information, please visit the Support Center.

*Source: Laevitas (June 2024)